Published Jan 15, 2025

4 signs your business needs accounting and finance automation

- Data silos and manual workflows hinder the efficiency of finance operations.

- This lack of integration and automation leads to inaccurate data, delays, and more.

- Integrate your systems with iPaaS to streamline workflows and improve decision-making.

Over the past few years, the number of specialized finance and accounting SaaS applications has exploded. While this has revolutionized workflows, it has also introduced data silos that can lead to misalignment between sales and finance teams.

Data silos arise when sales and finance teams operate in separate systems that aren’t integrated. Without integration, data can’t flow between tools, forcing finance and accounting teams to manually re-enter information across systems. This increases the risk of processing errors, added costs, and inaccurate data.

Unfortunately, re-entering data is just one of the challenges caused by data silos. These silos often force teams to rely on manual tasks or spreadsheets to complete processes. This results in inefficiencies and mistakes that can cost companies up to 1,920 hours on a 20 person finance team.

Breaking down data silos and automating manual processes starts with identifying areas of inefficiency within your business. In this blog, we’ll explore four key indicators that signal it’s time to adopt accounting and finance automation and offer ways to solve them to improve your financial operations.

Sign 1: Inaccurate data

A recent study by CEO Today found that more than 40% of global financial leaders don’t trust the accuracy of their financial data. This lack of accurate data often stems from teams relying on multiple, disconnected systems for accounting purposes. When your customer relationship management (CRM), enterprise resource planning (ERP), billing, and configure, price, quote (CPQ) systems fail to sync data, it creates discrepancies. These discrepancies lead to poor decision-making, compliance issues, wasted time and resources, and overall mistrust in the numbers.

Because of this, many teams turn to manual processes to gather data and generate accurate financial reports, plans, and analysis. This can take up 70% of finance professionals’ time and cause inefficiencies, especially when different systems use different standards for data management. Additionally, these manual processes lack version control, audit trails, consistency, and scalability.

If this sounds like your business, it’s time to integrate your key finance and accounting systems with an advanced iPaaS (Integration Platform as a Service) like Celigo. By doing so, you can enhance the quality and accuracy of your financial data, eliminate the need for manual data entry, and automate essential processes like quote-to-cash, accounts payable/receivable (AP/AR), procure-to-pay, and expense management.

Sign 2: Inefficient quoting processes

The quote-to-cash process has many steps, including identifying an opportunity, creating a quote for the prospect, signing the contract, processing the order, billing, and recognizing revenue. This means there’s lots of opportunity for errors and delays when using manual processes. These inefficiencies result in a lack of order visibility, slow revenue reconciliation, lengthened sales cycles, and ultimately, slow growth.

Automating the quote-to-cash process eliminates inefficient manual processes and minimizes the costs associated with time-consuming administrative tasks, inaccurate quotes, and billing mistakes. To achieve this, you’ll need to integrate your CRM and ERP. This will allow you to sync contacts, accounts, and opportunities between systems, creating a unified source of truth.

You can also streamline contract execution and billing processes with automation. By integrating your CRM with contract management software like DocuSign, Adobe Sign, or PandaDoc, you can sync contracts and eSignatures between systems. Subsequently, by integrating your CPQ with your billing system, you can sync orders and subscription information. This ensures that your recurring billing platform has reliable, accurate information.

Explore key results surveyed businesses have achieved with an automated quote-to-cash process:

- Accelerated payment cycles by up to 30%

- Reduced payment delays by 50%

- Lowered sales and finance costs by at least 5%

Sign 3: Delays in closing the books

The amount of time your team spends doing accounts payable is a telltale sign that you need automation, and this issue is currently widespread—72% of finance teams spend up to 10 hours per week on accounts payable tasks. These manual tasks consume valuable time and resources and limit your capacity to handle large data volumes, hindering your ability to scale and manage new business.

Explore how automation can help you enhance your accounts payable process:

- Improve the cash receipt process by ensuring they are reflected in your GL and AR sub-ledger, enabling your collections team to start from the right place on paid invoices.

- Increase visibility into cash flow by automating bank receipts and invoice matching.

- Reduce manual activities by up to 90% by automating your ERP bank transactions and streamlining your accounting processes.

- Improve cash flow and reduce day sales outstanding (DSO).

- Save time and minimize errors by automating your AP and AR processes.

- Reduce compliance costs by up to 50%.

Automating these types of file transfers allows companies to reduce operating costs, strengthen vendor relationships, improve compliance with internal controls, and scale quickly without adding more staff.

Sign 4: Lack of visibility and timely cash reporting

In a global survey of C-suite executives and finance professionals, 69% of respondents said they think they or their CEO has made a significant business decision based on out-of-date or incorrect financial data. When there are data silos between the CRM, ERP, billing, and CPQ systems, discrepancies in data cause inaccurate financial reports. This can result in poor strategic decisions, incorrect forecasts, compliance issues, and ineffective resource allocation.

To determine if your business has the data visibility needed to give accurate cash reports, ask yourself these questions:

- Can you confidently run accurate and up-to-date reports?

- Do you need more visibility into payments coming in, especially from large customers?

- Do you need more visibility on what your organization is spending?

- How long does it take to reflect in the general ledger when crediting a bank account?

- How long does it take to reflect into your sub-ledger for accurate reporting?

- How many weekly hours does each team member manually work with these processes?

Solving your finance challenges with automation

If your business is experiencing any of the signs above, it’s time to start integrating your systems and automating your processes. Integration-driven automation in finance and accounting enables confident KPI tracking, real-time cash visibility, and accurate performance reporting, ensuring data-driven decision-making.

Creating an integration strategy

To fully harness the benefits of automation, it’s crucial to develop a comprehensive integration strategy. This strategy serves as the foundation for breaking down data silos and prioritizing key processes for automation. Begin by evaluating the processes where automation will have the greatest impact.

- Quote-to-cash: Improve cash flow by automating billing and order management, and eliminate data silos between CRM, ERP, and CPQ systems.

- Accounts receivable: Enable your AR department to work more efficiently by consolidating critical information, like account statuses and payment histories, all in one place. Eliminate manual tasks and improve customer outreach by automatically generating invoices, emailing payment reminders, and providing multiple payment options.

- Accounts payable: Eliminate manual billing, collections, and invoice processes by integrating AR and AP systems with your ERP. Get paid faster and remove the possibility of sending inaccurate contracts.

- Financial close: Automate FTP transfers of vendor payment files and summary files between your ERP and bank. By automating these types of file transfers, you can reduce operating costs, strengthen vendor relationships, and improve compliance with internal controls.

- Financial reporting and analysis: Get accurate, real-time KPI visibility and financial reporting across sales and finance systems. Ingest financial data into a data warehouse, and eliminate manual data dumps into spreadsheets that can lead to outdated reports.

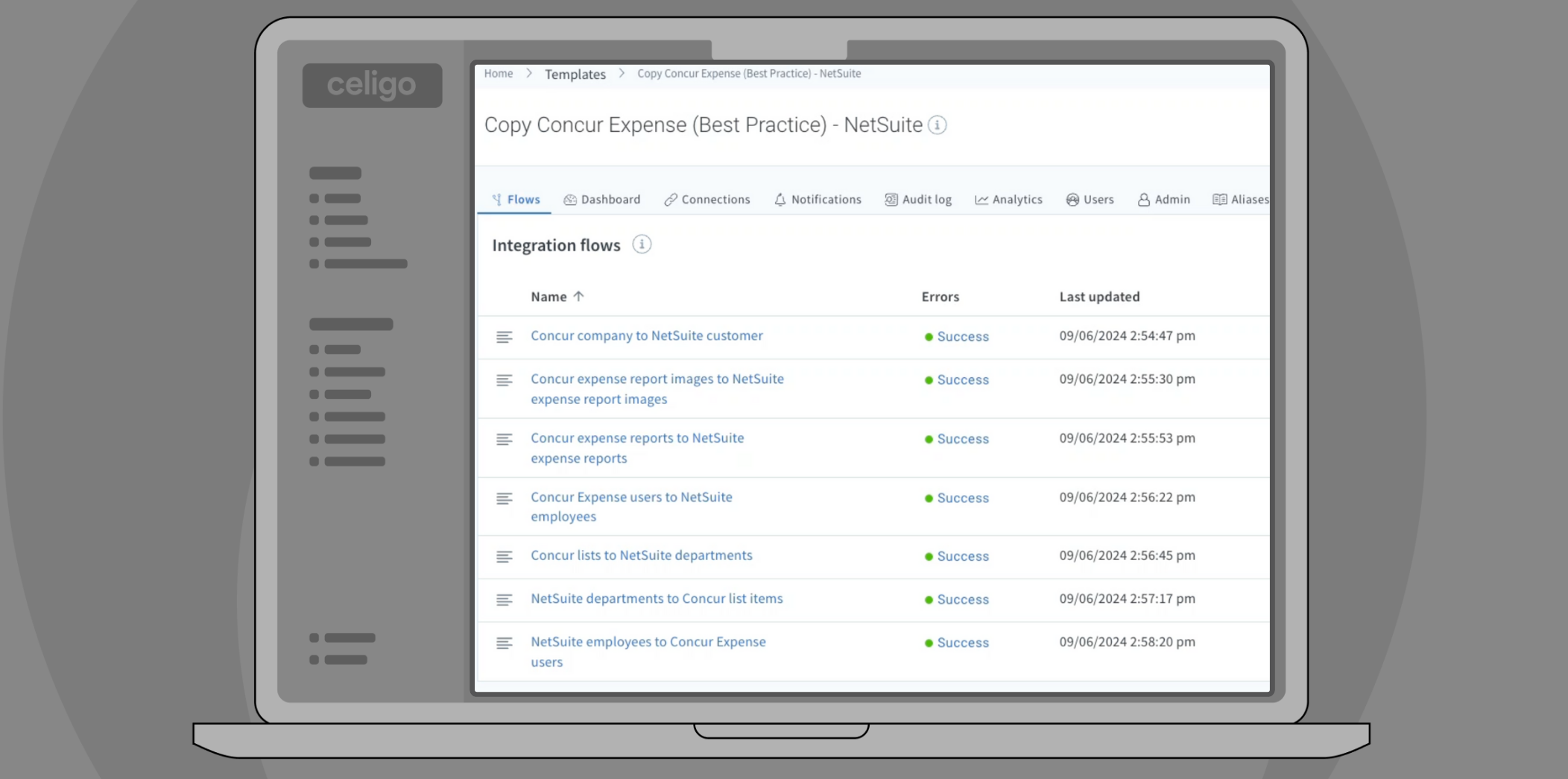

- Expense processing: Automatically reimburse employees while keeping your financial data accurate by syncing employee records with your expense management system.

- Procure-to-pay: Reduce costly procurement errors and increase policy compliance and speed to order, all while improving your financial visibility. Ingest data from multiple systems to provide transactional transparency throughout the procurement process.

By addressing common finance challenges with automation, your business can streamline processes, eliminate inefficiencies, and enhance financial visibility. Start integrating your systems today to unlock data-driven decision-making and sustainable growth.

To see what automating these accounting and finance processes could look like at your business, request a demo of Celigo’s iPaaS today.