Published Dec 23, 2024

Achieving the full potential of FP&A with integration

- Manual FP&A processes are inefficient, time-consuming, and error-prone.

- With integration, you can automate data collation and updates and performance tracking.

- This leads to better decision-making, improved data accuracy, and more.

As the business landscape continues to evolve, the financial strategies that worked yesterday may no longer deliver results tomorrow. To achieve sustainable success, finance leaders must adopt a forward-thinking and proactive strategy—one that maximizes cash flow efficiency, minimizes capital outlays, and enhances financial agility.

In order to accomplish this, you need to understand when and how to pivot. Financial planning and analysis (FP&A) plays a crucial role in this process by providing leaders with a framework to evaluate performance, predict future outcomes, and make data-driven decisions.

Unfortunately, the traditional FP&A process involves manually gathering data from multiple finance systems, reconciling that information, and building reports—a time-consuming and error-prone task. This approach leads to teams spending excessive time gathering and organizing data, which can consume over 70% of their time according to CFO.com, leaving only 30% for analysis.

The key to overcoming these inefficiencies is automation. Keep reading to learn why integration is critical for successful FP&A automation—and how it can unlock powerful benefits for your organization.

The role of integration in FP&A success

As responsibilities grow and resources remain limited, modern finance teams must focus on efficiency to meet increasing demands. Instead of spending hours on data reconciliation, teams need to concentrate on high-value initiatives like forecasting, budgeting, and aligning financial models with long-term goals. Integration makes this possible by allowing you to automatically sync data across systems, eliminating time-consuming manual tasks and automating business processes.

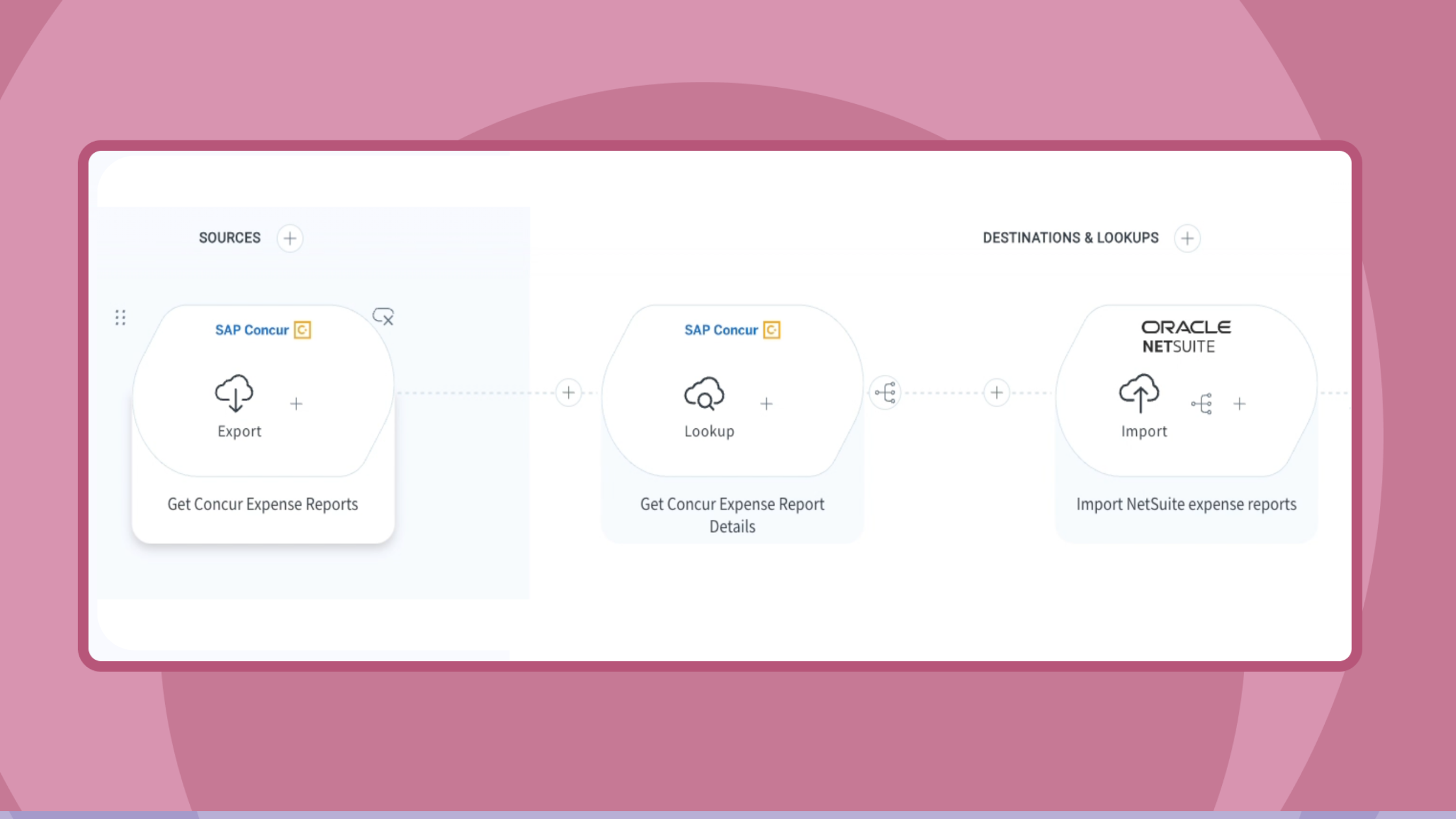

To accomplish this, you’ll need to integrate key systems like your accounts payable/accounts receivable (AP/AR), expense management, enterprise resource planning (ERP), billing, and revenue recognition software. This integration enhances FP&A in three critical areas:

- Multi-channel data collation: Once your systems are integrated, data can be automatically retrieved from various applications in real time. This eliminates the need for your team to manually collect and reformat data, saving time and enhancing efficiency.

- Continuous data updates: Manually entered data quickly becomes stale, preventing leaders from making decisions based on up-to-date and accurate information. With data syncing between systems, you can ensure each application reflects real-time changes in customer payments, expenses, sales, and other key metrics.

- Tracking performance and compliance: Without integration, teams struggle to ensure adherence to financial models, often missing opportunities for timely course correction. After integrating key systems, performance tracking, compliance monitoring, and real-time alerts can be automated—ensuring discrepancies are identified and addressed promptly.

4 key benefits of FP&A integration

By addressing these critical areas, integration not only resolves your immediate FP&A challenges but also unlocks key automations that transform your finance operations, such as:

- More time for strategic initiatives: Integration frees up your finance teams to work on high-value projects. In fact, a report by Deloitte found that companies using financial automation experience a 90% reduction in the time required to perform audit tasks. Rather than spending time on data entry and reconciliation, finance professionals can focus on analyzing trends, identifying opportunities, and contributing to long-term business goals.

- Improved data accuracy: With integration, you can significantly reduce the risk of errors. This leads to more reliable financial models and forecasts, giving finance teams confidence in their analyses.

- Better decision-making: Access to real-time data gives finance leaders a clear and accurate view of cash flow. Finance teams can then proactively address potential issues, optimize working capital, and ensure that the business remains financially healthy.

- Enhanced compliance: By automating your FP&A process, you can ensure compliance with regulatory requirements, reducing the risk of breaches. PwC found that this automation can reduce compliance costs by 50%.

Your path to financial agility

Achieving financial agility in an ever-changing market requires a shift from outdated, manual processes to an automated approach. An advanced iPaaS (Integration Platform as a Service), like Celigo, simplifies this transition by providing a unified, AI-powered platform that enables finance teams to build, manage, and monitor their own integrations.

If you’re ready to transform your financial processes and unlock new opportunities for growth, start integrating your systems today. Explore our ebook, “Transforming FP&A: How integration unlocks strategic growth,” to learn how.