Published Sep 16, 2024

Empowering business agility: The CIO’s role in navigating complex integration & business commerce

As businesses scale, the need for seamless integration between various systems becomes critical. For companies selling on platforms like Amazon, Shopify, and other ecommerce giants, financial complexity increases when handling split settlements, especially when selling across multiple regions. An Integration Platform as a Service (iPaaS) is designed to offer flexibility to accommodate these evolving needs, but even the most advanced solutions require careful configuration to align with unique business processes and financial requirements.

When you add the complexities of different countries, tax regulations, and the variety of products being sold, the settlement process quickly becomes a labyrinth of financial transactions, compliance hurdles, and logistical challenges. While many companies might be tempted to look for off-the-shelf “pre-built” solutions, the truth is that few—if any—of these offerings will fully meet the needs of your growing and diverse business. Instead, companies must select an iPaaS that offers flexibility, customization, and prebuilt connectors to fast-track critical business integrations.

How can a modern CIO/CTO adapt at the speed of business? Let’s dig in.

Understanding Amazon split settlements

The split settlement approach breaks down the settlement process into distinct steps, allowing for precise categorization and mapping of various transaction types—such as orders, refunds, and fees—to the appropriate general ledger (GL) accounts. For businesses that operate across multiple marketplaces or regions, the split settlement process offers greater control and visibility over financial transactions.

This approach also enables improved reconciliation, streamlined accounting, better compliance and auditing capabilities, and enhanced cash flow management. However, to effectively implement a split settlement strategy, businesses must be aware of several considerations, particularly when operating across different geographies.

Europe: A case study in complexity

For businesses operating in Europe, split settlements come with added layers of complexity. Europe is not a single financial market, and tax regulations vary significantly between countries, complicating the reconciliation and compliance processes. For instance, the VAT (Value-Added Tax) rates differ from one country to another, and some countries have unique rules around tax reporting and compliance.

Additionally, currency conversion adds another layer of complexity. A company selling products across multiple European countries must account for varying exchange rates, payment processing fees, and differing regulations on cross-border transactions. These elements not only affect financial reconciliation, but also the speed and accuracy with which settlements can be made.

Key considerations for split settlements

Several key factors must be considered when setting up split settlements across different geographies:

- Tax compliance: Different tax structures across regions mean that a one-size-fits-all approach will not suffice. For example, in Europe, VAT compliance is crucial, and companies must ensure that settlements correctly account for varying VAT rates, tax obligations, and reporting standards.

- Currency exchange: In regions like Europe, where multiple currencies are in play, exchange rate fluctuations and conversion fees need to be accounted for in settlements. Understanding how the API of your ecommerce platform handles currency conversion is vital.

- Payment processing fees: Different countries may have different payment processing fees, and understanding these fees is key to accurate reconciliation. Many ecommerce platforms like Amazon or Shopify automatically deduct these fees during settlement, but how they report them can differ.

- Revenue reconciliation: The complexity of split settlements means that accurate revenue reconciliation can become a challenge, especially when selling across multiple regions or platforms. Your financial team’s maturity in revenue reconciliation processes will determine how smoothly your business handles these operations.

- Platform API capabilities: Not all ecommerce platforms are equal in how they handle split settlements. Platforms like Amazon, Shopify, and others each have their own API structures that may or may not easily accommodate complex settlement processes. Knowing the capabilities of each platform’s API is critical when deciding how to structure your split settlements.

Business processes and platform dependency

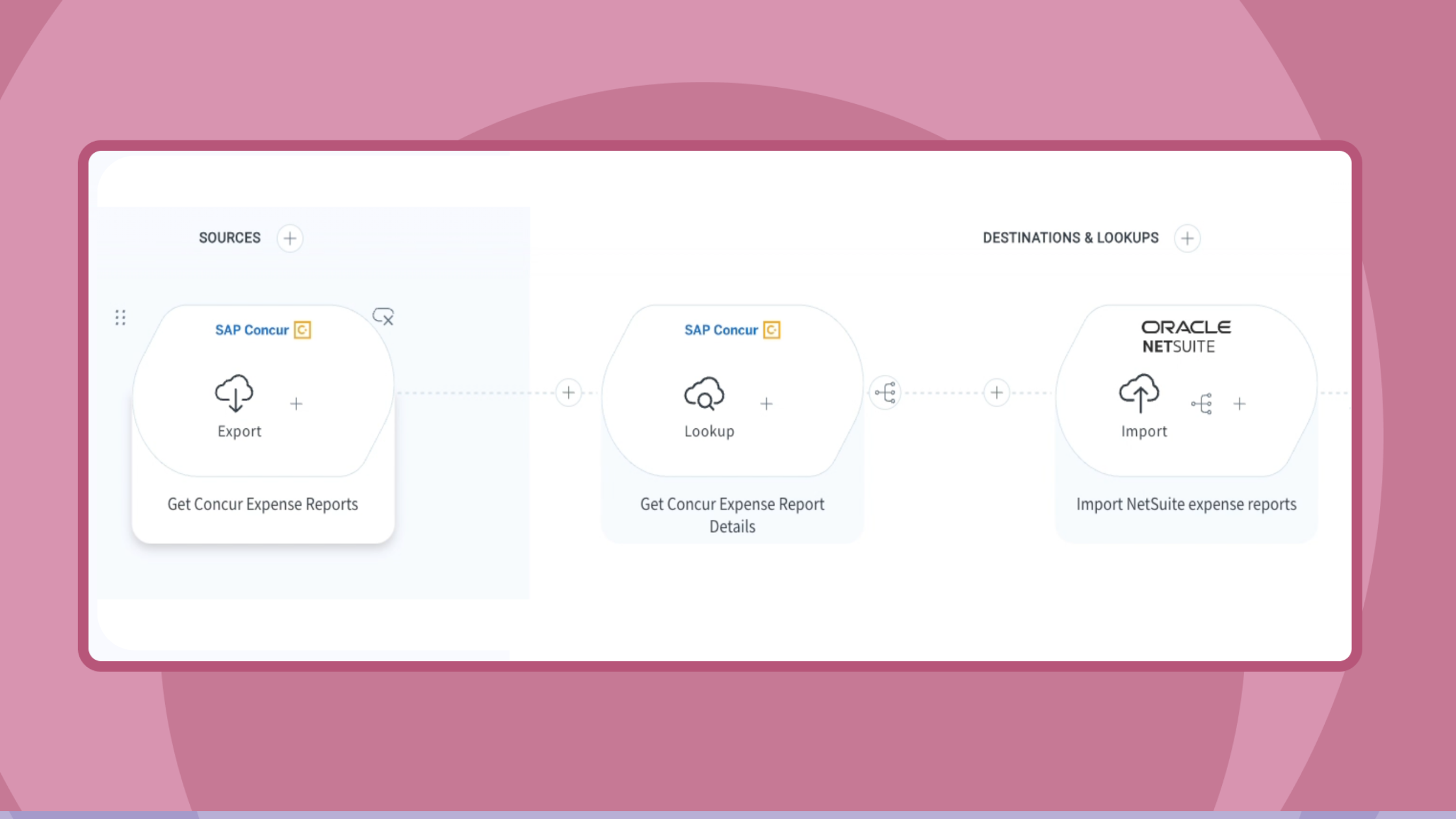

One of the biggest challenges in managing split settlements is aligning your business processes with the API capabilities of your selling platform and the overall architecture of your finance systems. This is where an iPaaS solution becomes indispensable.

At its core, an iPaaS allows for the seamless integration of multiple systems—sales platforms, financial systems, and business processes. However, the success of these integrations is heavily dependent on how tightly coupled your finance, accounting, IT, and business teams are.

Alignment across teams is critical

Achieving accurate and efficient settlements across geographies isn’t solely the responsibility of the finance team. A cross-functional alignment between finance, accounting, IT, and business operations is essential for success. These teams must collaborate to ensure that the integration flows are optimized, data is accurately captured, and business processes are adhered to.

The flexibility of an iPaaS is one of its greatest strengths, but that flexibility is only valuable when the teams utilizing the platform are in sync. From understanding the technical nuances of the ecommerce platform’s API to setting up the correct revenue recognition processes, all departments must have a shared understanding of the business goals and regulatory requirements.

Why flexibility matters

Many off-the-shelf integration solutions claim to solve split settlement challenges, but these solutions often fall short when a business’s needs evolve. That’s why it’s crucial to choose a flexible integration platform that allows for customizable workflows and offers prebuilt connectors to speed up implementation.

As your business scales, so do the complexities of your financial systems. New geographies, currencies, tax regulations, and product lines mean that what worked at a smaller scale may no longer suffice. A flexible integration platform gives you the ability to adapt and grow with your business, ensuring that your split settlement processes remain efficient, compliant, and accurate.

The role of the CIO/CTO in business agility

In today’s fast-paced business environment, the CIO and CTO are no longer just technology leaders—they are key stakeholders in driving business agility. The right integration platform can make or break a company’s ability to scale efficiently, especially when handling complex financial transactions like split settlements.

CIOs and CTOs must ensure that the integration platform they choose is not only flexible, but also aligns with the company’s overall business strategy. The ability to adapt to new selling platforms, manage evolving tax requirements, and scale across different regions is critical. Moreover, a platform that can easily integrate with core financial and sales systems ensures that businesses can remain nimble, even as they grow.

Conclusion

Amazon split settlements, particularly in complex regions like Europe, require a detailed and thoughtful approach. From tax compliance to API capabilities and cross-functional collaboration, there are many factors to consider. The right integration solution—one that offers flexibility, connectors, and tight integration with your financial systems—can make all the difference.

As businesses scale and enter new markets, the ability to manage split settlements efficiently will become a competitive advantage. By selecting the right platform that is adaptable, customizable, and designed to work with your existing systems, you set your business up for long-term success in today’s global marketplace.