Published Sep 26, 2024

Master your money with automation: Simplify expense tracking and payments

- Manually tracking and paying expense reports is unsustainable.

- Integrate expense management apps with central financial systems to eliminate manual tasks.

- Adopt an advanced iPaaS to automate your expense management process end-to-end.

Manually tracking and paying expense reports may not seem like a concern while your business is in its early stages, but as you grow, it quickly becomes unsustainable.

You’re then left with two options: hire more staff to manage these tedious manual tasks or leverage automation. Budget and resource constraints make automation the clear choice.

However, implementing expense management automation can be challenging. To streamline this process, you first must ensure your finance systems are integrated. This enables your core applications to sync data back and forth–eliminating manual data entry tasks and paving the way for automation.

Dive in to explore how automating expense tracking and payments can transform your business operations.

The hidden challenges of manual tasks

Without automation, tracking and paying expenses requires numerous manual steps, from uploading invoices to notifying approvers. This often leads to errors and delays.

Here’s a look at each manual step needed to track and pay expenses:

- Upload and submit invoices, noting the type of expense, amount, department, and other relevant information.

- Ensure the submitted expenses meet company policies and guidelines.

- Notify approvers that a new expense has been submitted and get their approval.

- Update expense status and prepare the expenses for payment.

- Once the expenses are paid, update their status to ensure accurate reporting and financial planning.

These manual steps waste your team’s time, prevent them from working on strategic initiatives, and lower productivity. On top of that, errors can lead to unhappy employees and vendors.

Streamline your workflows with integration

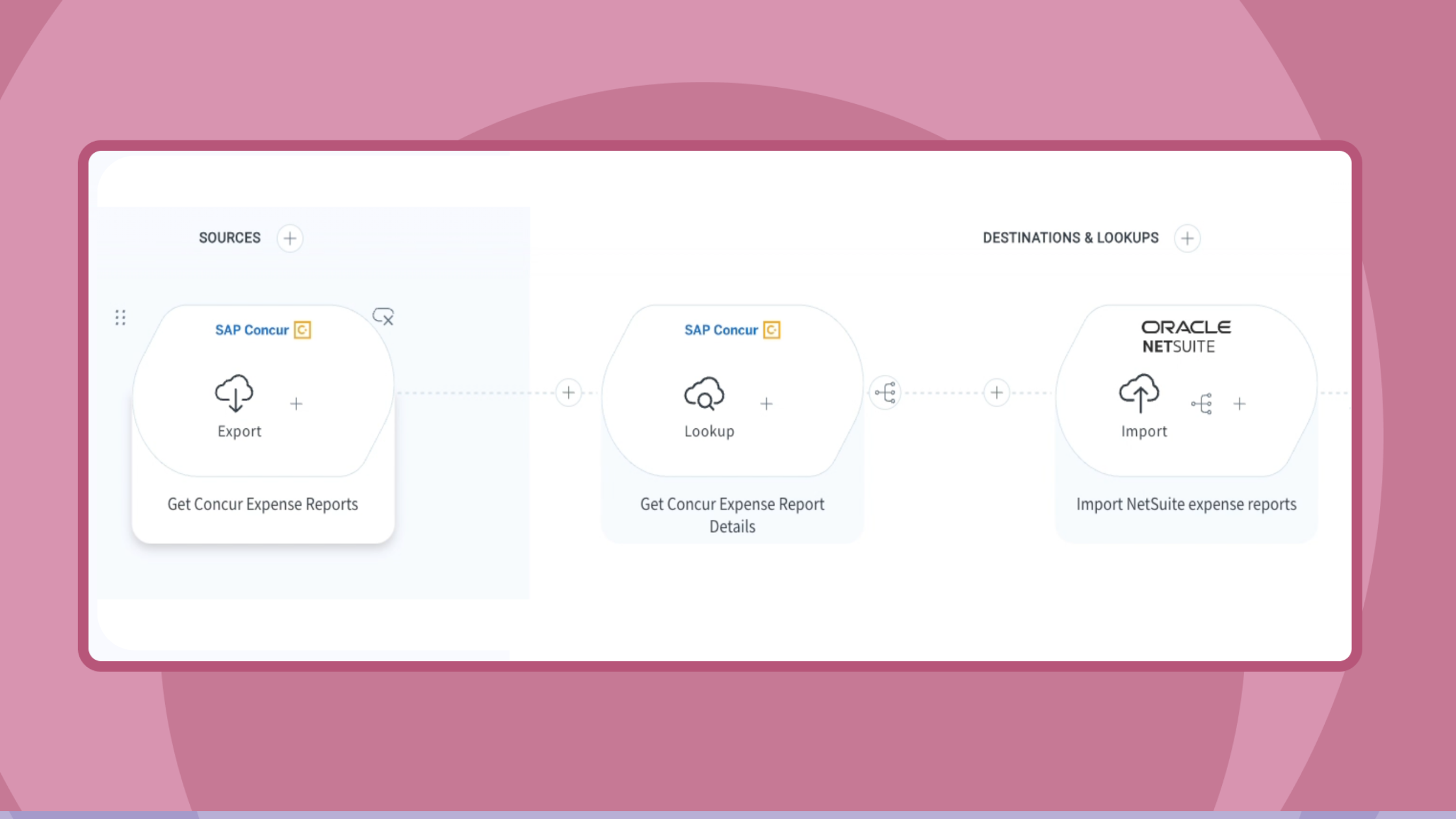

To automate these tasks, you’ll need to integrate your expense management system, such as Concur or Zoho, with your central financial system, like NetSuite or Dynamics 365. With these integrations in place, you can sync data between systems to implement automations.

Explore this example of what automation could look like for your business:

- Expenses raised in the expense management system are synced to your central financial system with relevant data like employee, department, and company information.

- Upon approval, updated statuses are synced from the expense management system to the central financial system, which then automatically creates payment invoices.

- After the payment is complete, records are updated across both systems, and confirmations are sent.

- When expenses are tied to specific projects, you can sync data with project management systems, ensuring that relevant projects are marked and billable items are updated accordingly.

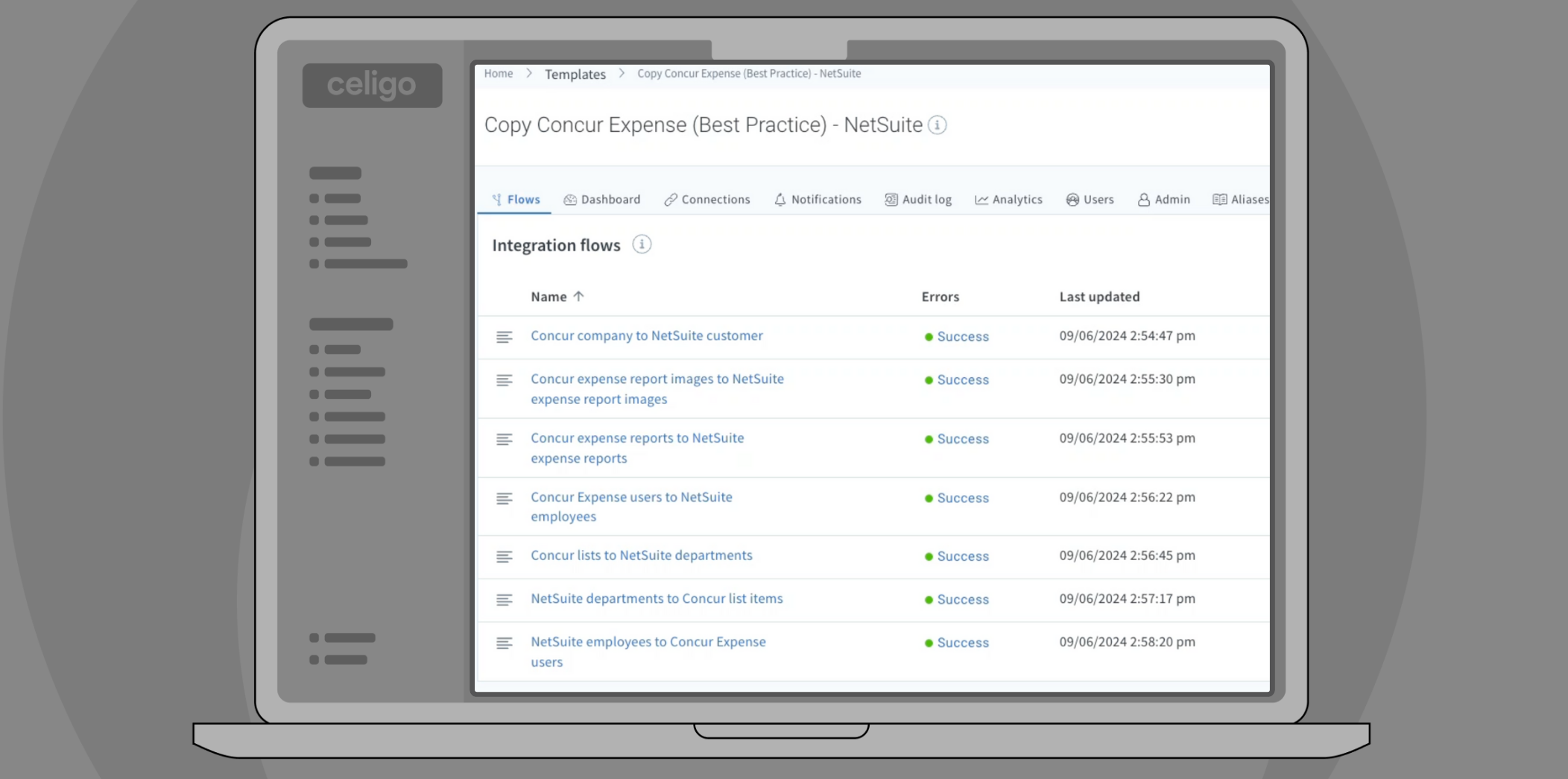

Elevate your finance processes with Celigo

By automating the tracking and payment of expenses, finance professionals can save both time and money. Automation allows you to guarantee policy compliance, ensure accuracy, and process expenses quickly. As a result, employees and vendors are paid faster, reducing stress related to filing expenses and waiting for reimbursements.

As you look to start integrating your finance systems, you’ll need to adopt an integration solution. There are a variety of integration solutions available to you, but many are expensive and require technical resources. To simplify the integration process and empower your finance team to build their own integrations, adopt an advanced iPaaS, like Celigo. Advanced iPaaS (Integration platform as a Service) solutions are built with non-technical users in mind, featuring an intuitive and low-code environment.

Learn more about how you can automate your expense management processes with Celigo, contact us today.