Published Sep 13, 2024

Tackling common expense management challenges: 3 keys to success

- Manual expense management processes lead to inefficiency and high operational costs.

- To eliminate these inefficiencies, integrate key systems and automate processes.

- With automation, you can improve expense tracking, budget planning, and compliance.

Many finance teams struggle with the burden of manual processes. In fact, 75% of finance professionals’ accounting processes are still manual. These processes aren’t just error-prone and inefficient, they’re expensive.

One of the most expensive accounting processes is expense management. Each manual expense could cost your business anywhere from $27 to $58 per expense. And, with 19% of expense reports being erroneous, you’ll waste $52 to correct each.

To eliminate these unnecessary costs, you’ll need to automate your expense management processes. In order to do so, you must connect your finance systems. This allows you to sync data between platforms–paving the way for automation.

Dive in to explore how you can solve your current expense management challenges with integration and automation.

Expense management inefficiencies

Manual expense management processes can lead to numerous inefficiencies within your business. These inefficiencies range from slow processes to noncompliance issues.

To truly eliminate these inefficiencies, you first need to understand how your business is being affected. Here are a few common expense management challenges that you could be facing:

- Fraud: Without clear financial visibility, it’s difficult to ensure you’re fulfilling the right expense reports. This makes you vulnerable to paying incorrect or fraudulent expenses.

- Incorrect financial data: When your financial systems can’t sync data between them, manual data entry tasks become necessary to complete your processes. This not only results in delays and errors, but also prevents you from getting clear financial data–hindering your ability to create accurate reports and forecasts.

- Compliance issues: Slow processes prevent you from quickly accessing expense data for taxation and auditing purposes. This leaves you unaware of potential liabilities and errors, putting you at risk of noncompliance.

3 key challenges to solve

To eliminate expense management inefficiencies once and for all, integrate your key systems and automate your expense management tasks.

When developing your integration and automation strategy for expense management, the greatest impact can be delivered to these three key areas: tracking and managing expenses, budget planning, and compliance.

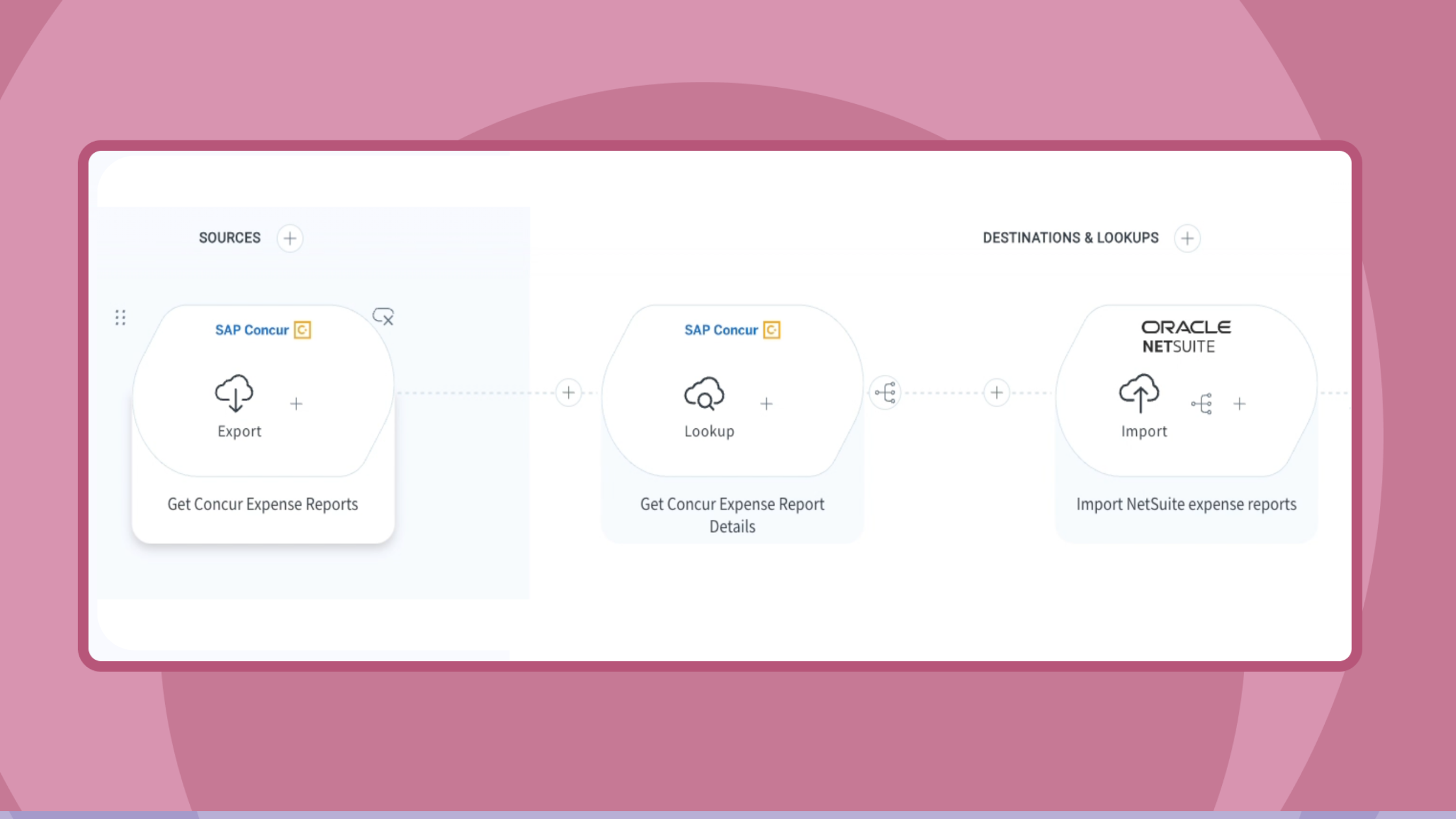

Tracking and paying expenses

Manually tracking and paying expenses can lead to lost reports, errors, and high operational costs. By integrating your expense management systems with your central finance and HR systems, you can streamline these workflows. This allows you to save time and money and refocus your teams on strategic projects. On top of that, automation allows you to complete payments faster–boosting employee satisfaction.

Budget planning

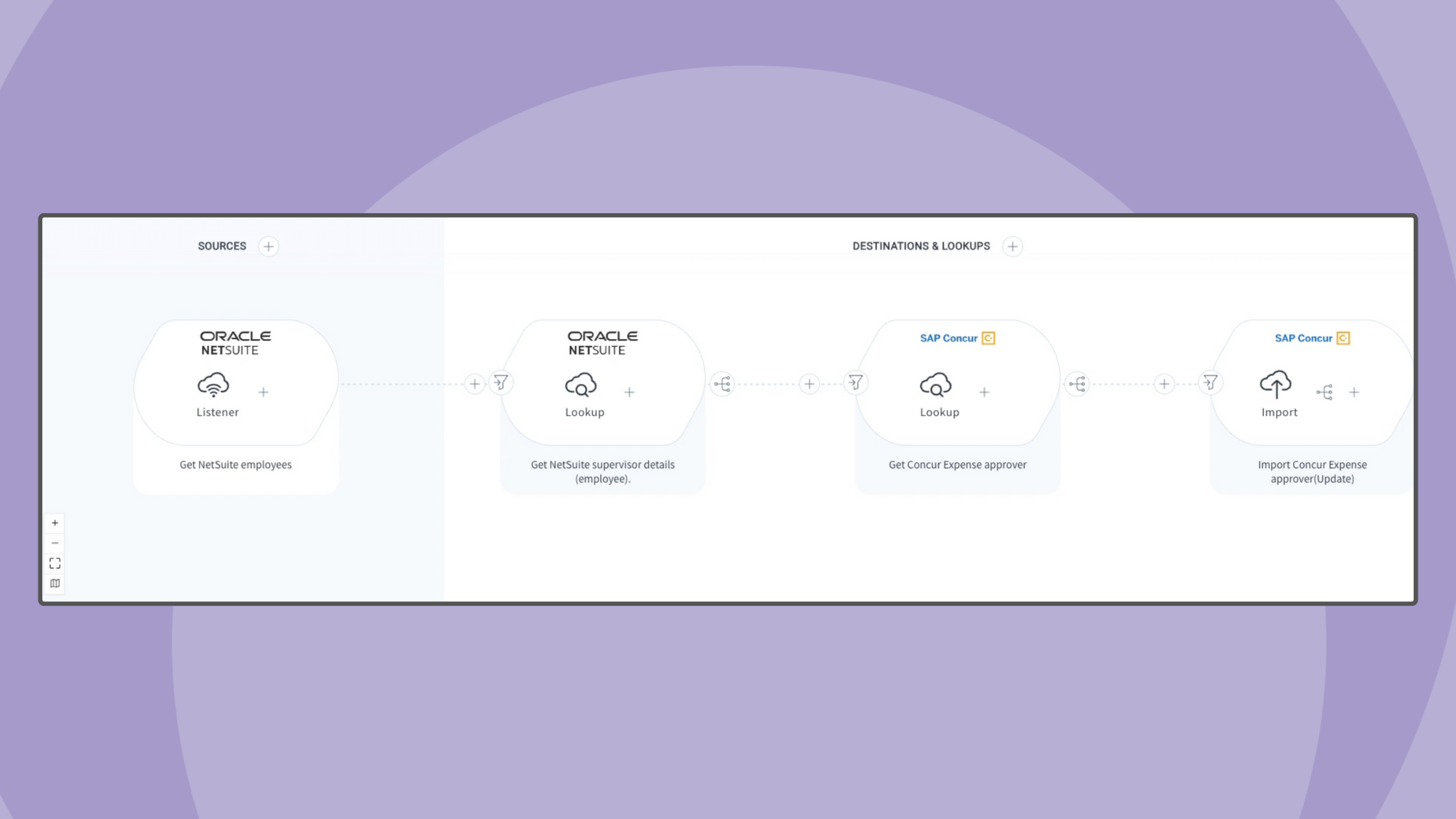

Estimating budgets accurately is impossible without accurate, up-to-date data. In order to get this data, you need to connect your financial planning systems with your expense management tools and your central financial system. With this integration, you can ensure precise budgets, financial statements, and cash flow predictions. You’ll also gain better visibility into costs and expenses–enabling you to make better business decisions.

Compliance

Manually reconciling data between systems causes errors, delays, and even tax noncompliance. To get the real-time data you need to guarantee compliance, connect your taxation system with your expense management system. This allows you to track tax compliance and meet auditing requirements. It also makes it easier to identify tax liabilities and ensure you’re paying the right amount of taxes.

Simplify integration with iPaaS

Automating your expense management processes is not just a matter of improving efficiency, it’s essential for reducing costs and mitigating risks. By integrating your key financial systems, you can eliminate manual inefficiencies, enhance data accuracy, and ensure compliance.

To complete these integrations quickly and efficiently, adopt an advanced iPaaS (Integration Platform as a Service). With iPaaS, you can simplify the integration building process and empower your finance teams to build, manage, and monitor their own integrations.

Embracing integration and automation empowers your organization to make informed decisions, streamline operations, and ultimately, cultivate a healthier financial environment. Learn how to make this a reality at your business. Contact us today.